Image by pshab via Flickr

Image by pshab via Flickr

No it's not drastic, but it is far and away more than any previous administration in the United States have ever committed to. A 17% reduction in CO2 levels by 2020, below the 2005 level. It's not Kyoto, but it is a solid commitment, and when the USA leads, everyone else is bound to follow. Even China, who has taken over the title as worlds biggest polluter this year (from the USA) is catching the drift with some promises of Carbon reducing policies of it's own.

Canada's Prime Minister as well as many other world leaders will also be in attendance at Copenhagen. Now you must ask yourself, what affect will this have on my Retirefund?

In a nutshell, it is a complete game changer and will have a huge affect on investments all over the world. If these leaders come to an agreement, no matter how small, on reducing their carbon footprint on this planet, it is the beginning of the end for some companies and industries and it is the beginning of great wealth and prosperity for other companies who embrace the Green Energy revolution that is just beginning. The COP15 summit is the catalyst which puts this revolution into overdrive. That's how much of a game changer it is.

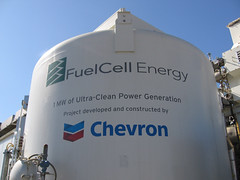

At this writing, California is legislating that fully 20% of all energy produced in the State beginning in 2010, must come from renewable resources. Federally in the U.S., there is a strong movement to legislate a similar law for the entire Country of 15% of total energy being produced by renewable resources beyond 2010. Billions of dollars are in play. Wind and Solar companies are springing up like the oil derricks of the 1890's. The "hydrogen highway" is being built in California. Hydrogen fuel cells burning, at first, natural gas and eventually pure hydrogen, will eventually play the major part in the greening of our planet. This is no time to be a wallflower. If you are not invested in the green revolution, you will merely be a spectator in the game, which will be the greatest wealth building era since the industrial revolution.

Make no mistake (as President Obama likes to say) This is a game changer. If you are invested in coal energy, you should probably get out now! If you are invested in pure oil plays you still have some time. If you are piling your money into Wind and Solar companies, you should maybe take a double check on that. They will eventually only be bit players in this great game but they will gain significantly in the short to medium term. Hydrogen is the future of energy, no matter how you look at it, and Natural gas is a great store of hydrogen for fuel cells, which have the greatest potential to produce the most wealth. PEM fuel cells can be stacked and therefore, can produce energy at the back up generator level, and at the giant energy plant level. They have the capacity to actually replace large oil fired, coal fired, and even nuclear power plants.

There will be flashes in the pan, so to speak, of ideas that, at first seem like solutions, but that will peter out like a late night camp fire. Clean coal (an oxymoron - as there is no such thing as clean coal) is the obvious one. Corn ethanol is another. It produces at least the same or even more carbon in it's production, than it saves by it's use as a gasoline additive.

"Could be the largest economic opportunity of the 21st century."

- Venture Capital Firm Kleiner Perkins Caufield and Byers

- Venture Capital Firm Kleiner Perkins Caufield and Byers

Do your homework and do it well before you invest, but don't sit on the sidelines of this great race. As Wayne Gretzky once said, "You miss 100% of the shots you don't take"!

Our top pick:

Ballard Power Systems

BLD-T

BLDP-NASDAQ

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=41936ea8-fab7-4a99-92f4-0fee9b9170cb)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=5f9608cc-2e58-4f0c-8df6-2f3128a1ebfb)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ee03abfb-bb78-4a96-b459-09fdf77aef41)